tax shield formula uk

To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. Tax Shield Deduction x Tax Rate.

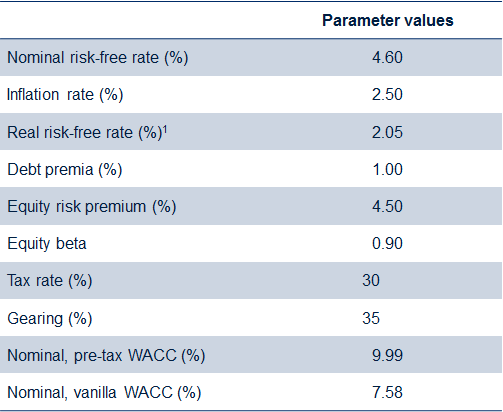

Which Wacc When A Cost Of Capital Puzzle Revisited Oxera

Depreciation Tax Shield Depreciation Expense X Tax Rate As you can see with this formula you can calculate how much you can shield yourself from taxes by leveraging.

. What is the formula for tax shield. Assume Case A brings after-tax income of 80 per year forever. Interest Tax Shield 3500 2500 125100 Interest Tax Shield 109375.

This is usually the deduction multiplied by the tax rate. A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAI CE Investment Cost Marginal Rate of Income tax Rate of Capital. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be manually calculated by subtracting the salvage value ie.

You calculate depreciation tax shield by taking 100000 X 20 20000. This is usually the deduction multiplied by the tax rate. Tax Shield Deduction x Tax Rate.

Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest. Under this assumption the value of the tax shield is. It can be calculated by multiplying the deductible depreciation expense by the tax rate applicable to your business.

Interest Tax Shield Formula Average debt Cost of debt Tax rate. The Amount of Tax to be paid is calculated as TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses x tax rate or EBT x tax rate We note that. The formula for this calculation can be presented as follows.

TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest. Depreciation Tax Shield Formula In order to calculate the depreciation tax shield the first step is to find a. Tax Shield Amount of tax-deductible expense x Tax rate For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the tax shield approach.

To learn more launch. Interest Tax Shield Average debt Cost of debt Tax rate. The formula for calculating the interest tax shield is as follows.

Tax Shield 5000 40000 10000 35. Interest bearing debt x tax rate. The effect of a tax shield can be determined using a formula.

Tax Shield Amount of tax-deductible expense x Tax rate. The effect of a tax shield can be determined using a formula. Tax Shield Formula Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate.

Tax Shield Donation to Charitable Trusts Interest Expenses Depreciation Expenses Applicable Tax Rate. Tax Shield is calculated as. Using the above examples.

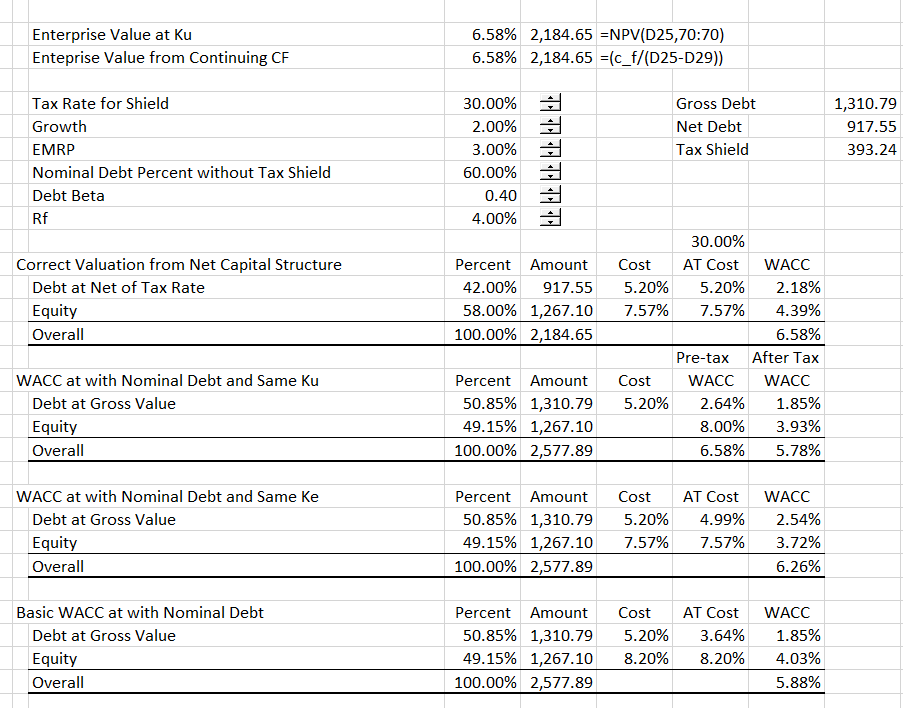

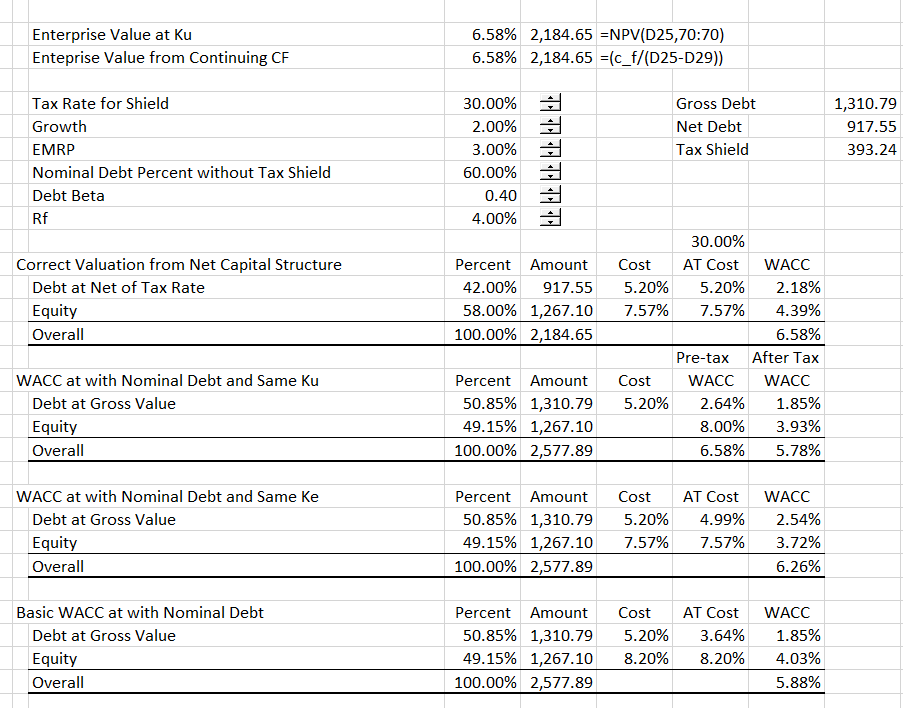

Wacc Adjustment To Correct Valuation Of Tax Shields Edward Bodmer Project And Corporate Finance

Pdf Tax Rate And Non Debt Tax Shield

Depreciation Tax Shield Formula And Calculation

Interest And Tax Shield In Wacc Part 2 Youtube

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

It S A 10 Miracle Blow Dry H2o Shield 6 Oz Walmart Com

Next Level Racing Gtelite Formula And Hybrid Pedal Upgrade Kit Dell Usa

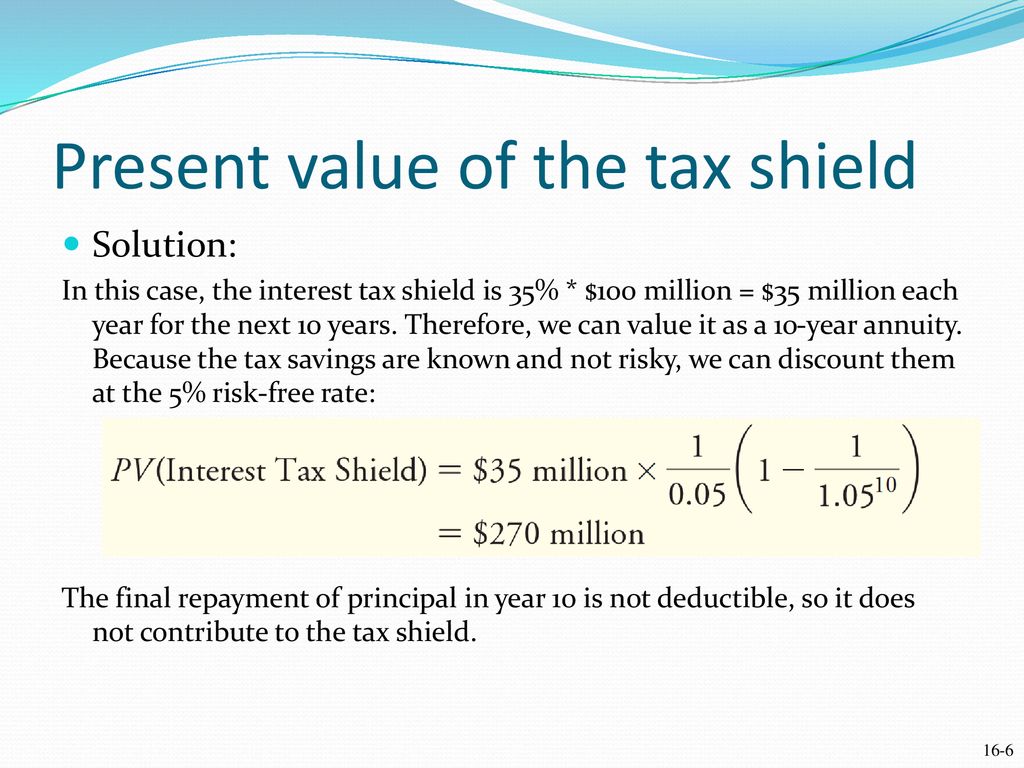

Out Of The Perfect Capital Market Role Of Taxes Ppt Download

Valuations Fi Chapter 17 To 20 Flashcards Quizlet

Chapter 15 Debt And Taxes Section 15 1 15 3 And 15 5 Flashcards Quizlet

Moneywatch Uk Prime Minister Liz Truss Pulls Proposed Tax Cut For High Earners Cbs News

Modelling The Impact Of Increased Alcohol Taxation On Alcohol Attributable Cancers In The Who European Region The Lancet Regional Health Europe

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

My Mommy Tax Six Months Of Nursing Cost More Than A Year Of Formula Kaitlin Bell Barnett The Guardian

As Uk Energy Bills Spike Bp And Shell Could Face Windfall Tax Cnn Business